12th Grade Great Recession Inquiry

Who's to Blame for the Great Recession?

Download the Entire Inquiry Here

Who's to Blame for the Great Recession?

Download the Entire Inquiry Here

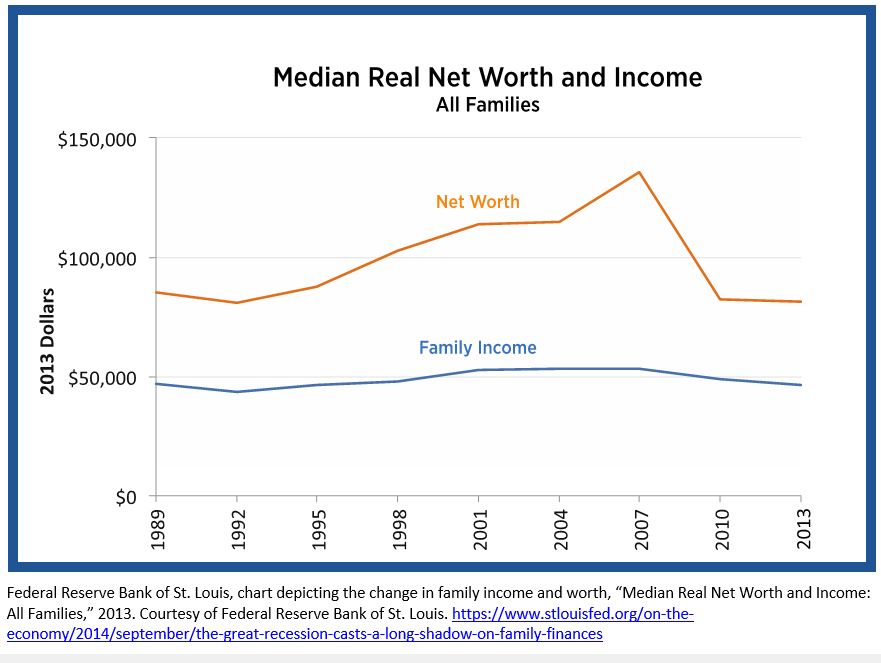

Staging the Compelling Question

Teachers could stage the compelling question by having students examine the impact of the Great Recession on the typical American family. According to the Federal Reserve, median real net worth of the American family declined 40.1 percent between 2007 and 2013. Economists Ray Boshara, William Emmons, and Bryan Noeth write that “the financial impact of the Great Recession was so severe that all the gains achieved during the 1990s and 2000s were wiped out” (See Staging the Compelling Question, Featured Source A). Students could then investigate who was held accountable and what changed as a result of the financial crisis (e.g., Dodd-Frank Wall Street Reform and Consumer Protection Act). Teachers could use this as an opportunity to launch the compelling question “Who’s to blame for the Great Recession?” and to preview the inquiry extension of bringing the sectors of the economy to justice.

Teachers could stage the compelling question by having students examine the impact of the Great Recession on the typical American family. According to the Federal Reserve, median real net worth of the American family declined 40.1 percent between 2007 and 2013. Economists Ray Boshara, William Emmons, and Bryan Noeth write that “the financial impact of the Great Recession was so severe that all the gains achieved during the 1990s and 2000s were wiped out” (See Staging the Compelling Question, Featured Source A). Students could then investigate who was held accountable and what changed as a result of the financial crisis (e.g., Dodd-Frank Wall Street Reform and Consumer Protection Act). Teachers could use this as an opportunity to launch the compelling question “Who’s to blame for the Great Recession?” and to preview the inquiry extension of bringing the sectors of the economy to justice.

- Source A: Ray Boshara, William Emmons, and Bryan Noeth, article describing the effect of the recession on the American family, ”The Great Recession Casts a Long Shadow on Family Finances” (excerpts), September 9, 2014

Supporting Question 1- What role did the government play in causing the Great Recession?

- Formative Performance Task- List government actions that caused or led to the Great Recession and state the impact those actions had on the economy. Support each statement with evidence.

Supporting Question 2- What role did consumers play in causing the Great Recession?

- Formative Performance Task- List consumers’ actions that caused or led to the Great Recession and state the impact those actions had on the economy. Support each statement with evidence.

Supporting Question 3- What role did financial institutions play in causing the Great Recession?

- Formative Performance Task- List financial institutions’ actions that caused or led to the Great Recession and state the impact those actions had on the economy. Support each statement with evidence.

- Source A: Financial Crisis Inquiry Commission, report on causes and scope of the financial crisis of 2007-2008, “Conclusions of the Financial Crisis Inquiry Commission,” January 2011 Courtesy of Peter J. Wallison, Arthur F. Burns Fellow in Financial Policy Studies, American Enterprise Institute. Used with Permission.

http://cybercemetery.unt.edu/archive/fcic/20110310173538/http://www.fcic.gov/report - Source B: Peter Wallison and Arthur Burns, opinion that the financial crisis was caused by deregulation and predatory lending practices, “Conclusions of the Financial Crisis Inquiry Commission, Dissenting Statement,” January 2011

- Courtesy of Peter J. Wallison, Arthur F. Burns Fellow in Financial Policy Studies, American Enterprise Institute. Used with Permission. http://cybercemetery.unt.edu/archive/

- Source C: Staff writers, list of people claimed to be responsible for the financial crisis of 2007-2008, “25 People to Blame for the Financial Crisis: The Good Intentions, Bad Managers, and Greed behind the Meltdown,” Time, 2009 From the pages of TIME. © 2009 Time, Inc. All rights reserved. Reprinted/Translated from TIME and published with permission of Time, Inc. Reproduction in any manner in any language in whole or in part without written permission is prohibited. http://content.time.com/time/specials/packages/article/0,28804,1877351_1878509_1878508,00.html#.

- Source D: Staff writers, article describing the causes and effects of the financial crisis, “The Origins of the Financial Crisis,” The Economist, September 7, 2011 “The origins of the financial crisis: Crash course’, The Economist, 7 Sept 2013 http://www.economist.com/node/21584534 © The Economist newspaper Limited, London (7 Sept 2013). http://www.economist.com/node/21584534/print.

- Source E: Andrew Sorkin, prologue about the financial crisis from the viewpoint of the JP Morgan CEO, Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System—And Themselves, 2009 From Too Big to Fail, Andrew Ross Sorkin. Copyright © 2009 by Andrew Ross Sorkin. Used by permission of Viking Books, an imprint of Penguin Publishing Group, a division of Penguin Random House LLC.

- Source F: Center for Responsible Lending, video overview of and article about the root causes of the financial crisis of 2007-2008, State of Lending: Mortgages, December 12, 2012.

- Source G: President Barak Obama, remarks at the signing of Dodd-Frank Wall Street Reform and Consumer Protection Act, July 21, 2010.

- Source H: David Brooks, editorial that examines the growing tolerance of debt, “The Debt Indulgence,” New York Times, June 4, 2012.

- Source I: Tyler Cowen, article examining fraudulent borrowing practices on the part of consumers leading up to the financial crisis of 2007-2008, “So We Thought. But Then Again . . .” (excerpt), New York Times, January 13, 2008.”

- Source J: Meta Brown, Andrew Haughwout, Donghoon Lee, and Wilbert van der Klaauw, study examining total consumer debt over time, “The Financial Crisis at the Kitchen Table: Trends in Household Debt and Credit” (excerpt), 2013